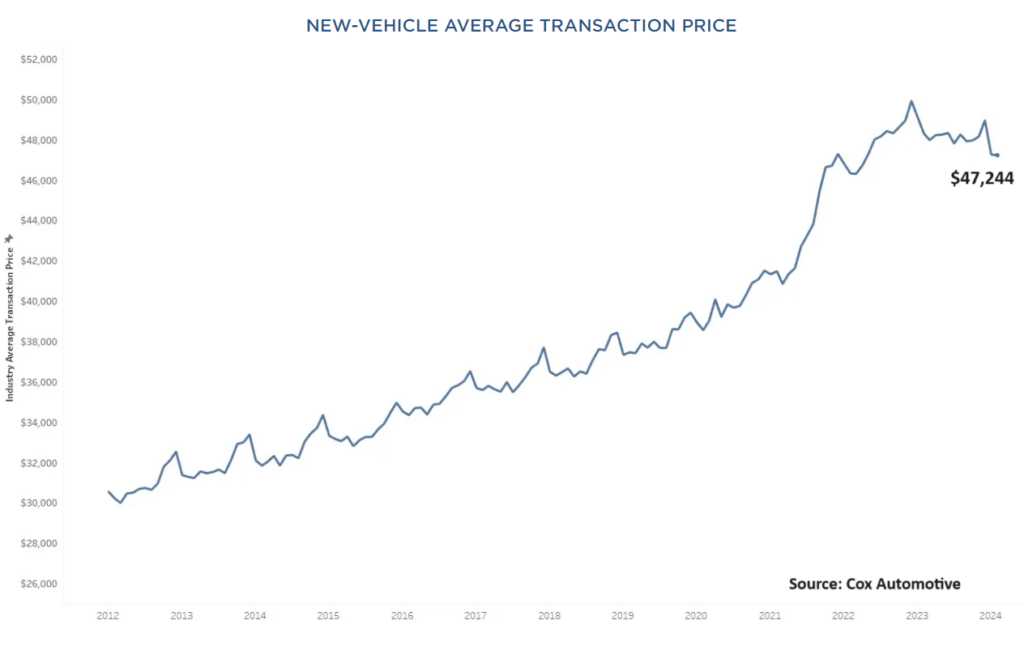

According to recent data, the car market is doing something it has not done in a while: car prices are holding steady. Things have calmed after a few years of ups and downs caused by the pandemic, supply chain shortages, and customer demand.

The bad news is that those stable prices are at some of their highest levels ever recorded.

The State of the Car Market

According to Kelley Blue Book, the average cost of a new car in February 2024 has reached an all-time high of over $47,000. This is actually a decrease of 2.2% from the prior year and 5.4% from the top price point hit in December 2022.

Much of this is also due to the increasing interest in large SUVs and pickup trucks which come at much higher prices than smaller cars.

Middle-class salaries in the U.S. have not kept pace with these rising prices, making it increasingly difficult for the average American to afford a new vehicle.

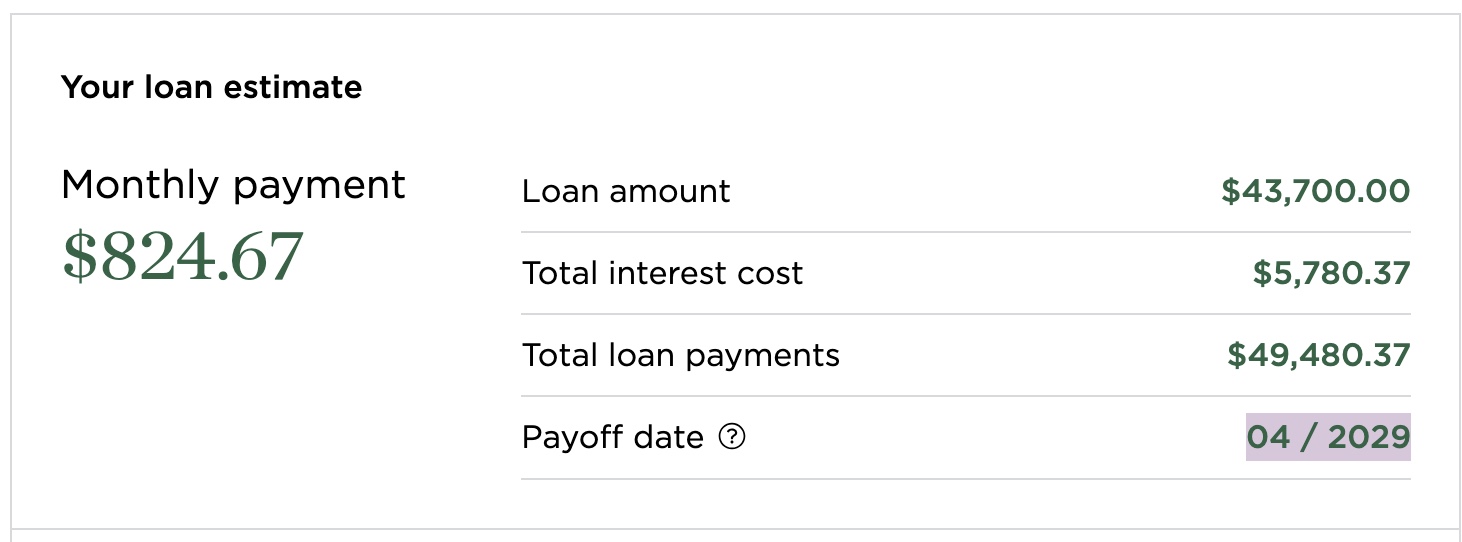

Imagine you buy a car for $47,700. You put $5,000 down and finance $42,700 at 5% for 60 months. Below is what your monthly payment might be.

Yes, that is $824 per month!

The current market rates for loans are higher than 5%, and if you have poor credit, expect to pay quite a bit more.

Middle Class Salaries

According to the U.S. Bureau of Labor Statistics, the median annual income for full-time workers in 2023 was $59,540. Middle-class income ranges from approximately $40,000-$119,000 annually. The large salary range is due to location.

Someone making $110,000 in the Northeast may be living just as well as someone making $45,000 in Oklahoma due to the cost of living variations. These salaries do not offer a lot of wiggle room for large car payments.

Can You Afford a New Car?

Before you head to the dealership, it’s crucial to take a close look at your financial situation.

Consider your income, credit score, and other expenses, such as insurance, gas, and maintenance. Two popular rules of thumb to determine affordability are the 20/4/10 rule and the 35% rule.

- The 20/4/10 rule states that your down payment should be 20%, your loan should be no longer than four years, and your monthly transportation costs should be less than 10% of your gross income.

- The 35% rule, on the other hand, suggests that your total vehicle costs should not exceed 35% of your gross monthly income.

While these guides are recommendations, they are not always aligned with your budget. If your gross income each month is $5,000 you may only take home $4,000. If you have a $800 car payment that leaves you $3200 left for mortgage, food, utilities, insurance etc.

That is not going to leave much for saving or investing for your future.

In addition, don’t let sneaky salespeople convince you that you can afford more than you can. Years ago you could only get a car loan for 3 or 4 years. Now, you can get a loan for 7 years – sometimes more. While this decreases your monthly payment, you are paying more for interest and paying a lot for something that depreciates fast.

Tips to Afford A Car

The reality is most middle-class Americans will be unable to comfortable afford a new car. But there are still options to get behind the wheel of a new car without breaking the bank.

Lending Tree data shows the average car payment hit a record in 2023 of $738 per month.

Here are a few tips to consider when buying a car:

- Consider an EV

Electric vehicle (EV) prices are dropping, and used EVs can be up to 20% cheaper than their original purchase price. Plus, you’ll save on fuel costs, as electric charging is generally much cheaper than gas. - Buy Used

Purchasing a three- to four-year-old vehicle can save you a significant amount of money, as new cars depreciate rapidly in the first few years. While used and classic cars have also seen increases in prices – there are still some good deals out there. - Choose a Low-Maintenance Car

Opt for a reliable brand like Honda, Toyota, or Hyundai, which typically have lower maintenance costs than luxury vehicles. - Make a Budget

Sit down and crunch the numbers to see what you can comfortably afford. Be sure to include all expenses and a buffer to really understand what kind of car payment you can afford. - Down Payment

The larger the down payment you can make, the less you will pay on interest. Save as much as you can before you head out to the dealer. - Incentives

Check all major manufacturers to see what kind of incentives they are offering. Some may offer 0% financing or other money saving options. Opt for these incentives when making a buying decision. - Interest Rates

Compare interest rates for loans. Car dealers will push their own loans but you may get better rates with your bank or credit union. - Negotiate

If you are interested in a specific make or model, do your homework. Check if the car is selling well or if there is a lot of inventory. This can help you bargain and negotiate a better deal. Do not be afraid to walk away and try a new dealer if one does not negotiate with you.

Ignore the Peer Pressure

Remember, the average American salary is not high enough to afford a brand-new car.

When you see your friends or colleagues driving the latest models, resist the temptation to keep up with the Joneses. Instead, focus on finding a car that fits your budget and lifestyle, and enjoy the peace of mind that comes with financial responsibility.

By following Humphrey Yang’s advice and prioritizing your long-term financial well-being, you can navigate the changing car market and find a reliable, affordable vehicle that will serve you well for years to come.

What To Consider When Buying a Classic Car

In the market for a classic car? Good for you! Check out some recommendations and things to consider before you do so you make a smart buying decision.